Navigating the Security finance Landscape in Corpus Christi, TX: A Comprehensive Guide

Corpus Christi, Texas, a vibrant coastal city, is a hub of economic activity and community life. Like any growing urban center, it faces unique financial challenges, particularly when it comes to security and financial stability. Security Finance, a company offering consumer loans, plays a role in this landscape. This article delves into the intricacies of security finance in Corpus Christi, exploring its services, potential benefits, associated risks, and the broader financial context of the city.

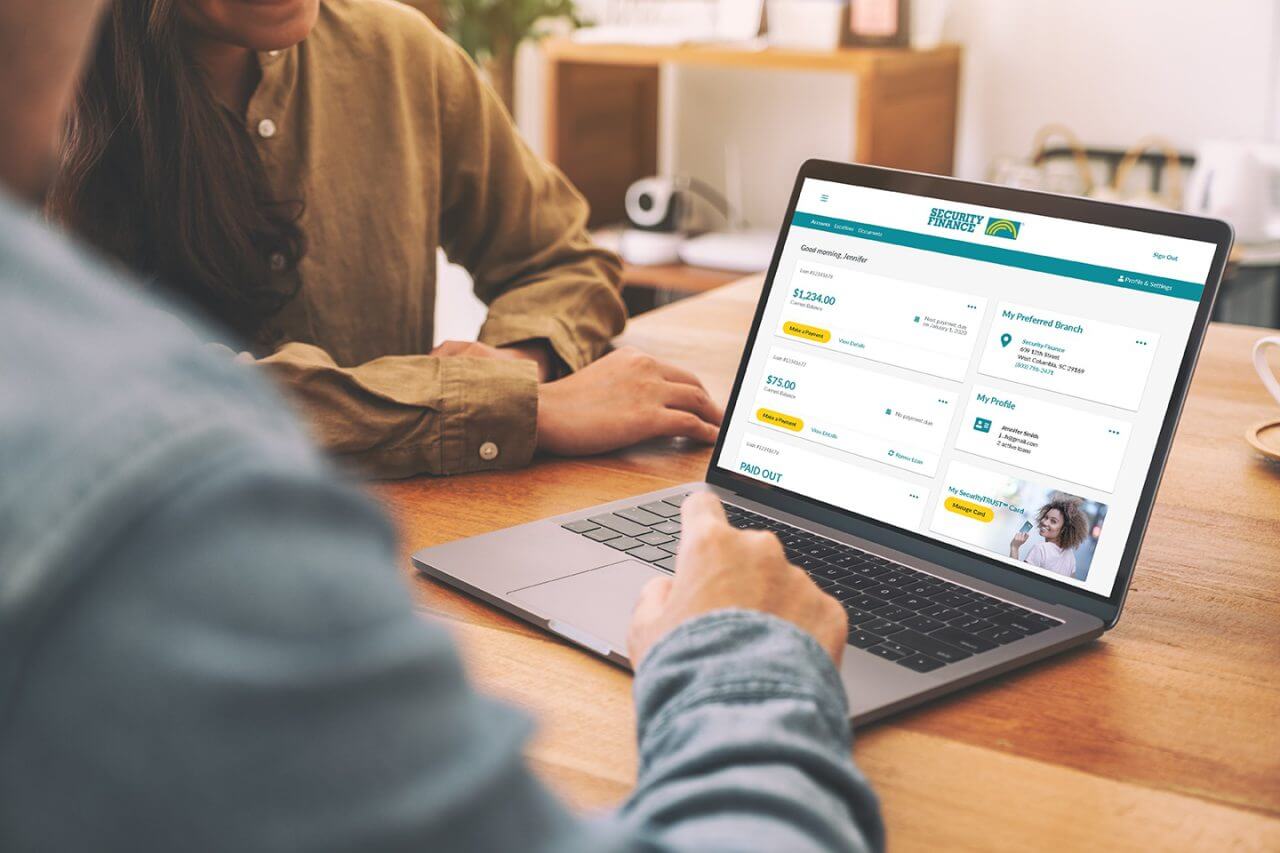

Security Finance, operating in Corpus Christi and beyond, provides installment loans to individuals. These loans are typically designed for those who may not qualify for traditional bank loans due to lower credit scores or limited credit history. The company often emphasizes accessibility and quick approval processes, catering to immediate financial needs.

What Services Does Security Finance Offer?

Security Finance primarily offers personal installment loans. These loans are characterized by:

Fixed repayment schedules: Borrowers make regular, scheduled payments over a set period.

The Appeal of Security Finance in a Coastal City

Corpus Christi’s economy, while diverse, can experience fluctuations due to its reliance on industries like tourism, oil and gas, and the port. These fluctuations can lead to financial instability for some residents. Security Finance may appeal to those facing:

Unexpected expenses: Medical bills, car repairs, or home emergencies can create immediate financial strain.

While Security Finance can provide a financial lifeline, it’s crucial to understand both the potential benefits and associated risks.

Potential Benefits:

Accessibility: Security Finance often caters to individuals with less-than-perfect credit, expanding access to credit.

Associated Risks:

Higher interest rates: Installment loans from finance companies often carry higher interest rates than traditional bank loans.

To understand the context of security finance in Corpus Christi, it’s essential to examine the city’s broader financial landscape.

Economic Factors:

Industry diversification: Corpus Christi’s economy is diversifying, but remains influenced by energy, shipping, and tourism.

Community Resources:

Credit counseling services: Organizations offering credit counseling and financial education can help residents manage debt and improve financial literacy.

The Impact of Financial Literacy

Financial literacy plays a critical role in navigating the complexities of personal finance. Residents who understand budgeting, credit management, and responsible borrowing are better equipped to make informed financial decisions.

When considering a loan from Security Finance or any other lender, it’s crucial to adopt responsible borrowing practices.

Steps to Take:

Assess your needs: Determine the exact amount you need to borrow and create a realistic budget for repayment.

Corpus Christi, like many cities, faces challenges related to financial stability and access to credit. Addressing these challenges requires a multifaceted approach.

Key Strategies:

Promoting financial literacy: Investing in financial education programs can empower residents to make informed financial decisions.

The future of security finance in Corpus Christi will likely be influenced by economic trends, regulatory changes, and evolving consumer needs. As the city continues to grow and diversify, the demand for accessible credit may increase. However, it’s essential to ensure that lending practices are responsible and that consumers are protected.

Potential Trends:

Increased regulation: Growing concerns about predatory lending may lead to increased regulation of the consumer finance industry.

Security Finance plays a role in the financial landscape of Corpus Christi, providing access to credit for individuals who may face challenges securing loans from traditional lenders. However, it’s crucial to understand the potential benefits and risks associated with these loans. By adopting responsible borrowing practices, promoting financial literacy, and addressing broader financial challenges, Corpus Christi can create a more equitable and sustainable financial environment for all its residents. It is very important that anyone using these services fully understand the terms of the loan, and seek help from financial advisors if needed.