Absolutely! Let’s craft a comprehensive 3000-word article on banks and financing options for Uber drivers, with a focus on practical information and replacing list items “ with `

` or `

` headings for better structure.

The rise of the gig economy has transformed how many people earn a living. Uber, a prominent player in this space, has provided countless individuals with flexible income opportunities. However, the nature of independent contracting often presents unique financial challenges, particularly when it comes to vehicle financing. Banks and financial institutions, while adapting, still operate within traditional frameworks, requiring Uber drivers to understand and navigate specific criteria to secure loans. This article delves into the intricacies of financing for Uber drivers, exploring the types of loans available, the requirements banks typically impose, and strategies for maximizing your chances of approval.

Before diving into financing options, it’s crucial to understand the financial profile of a typical Uber driver.

The Fluctuating Income Challenge

Uber drivers experience income fluctuations due to factors like demand, time of day, and seasonal variations. This inconsistency can make it difficult to demonstrate a stable income stream, a key factor for banks.

Vehicle Maintenance and Depreciation

Driving for Uber puts significant wear and tear on vehicles. Drivers must factor in maintenance costs, repairs, and the rapid depreciation of their vehicles, impacting their overall financial health.

Independent Contractor Status

As independent contractors, Uber drivers are responsible for self-employment taxes and do not receive the benefits of traditional employees, such as employer-sponsored health insurance or retirement plans.

Despite the challenges, several financing options are available to Uber drivers.

Traditional Auto Loans

These are the most common type of vehicle loan, offered by banks, credit unions, and dealerships. However, Uber drivers may face stricter requirements due to their income variability.

Requirements for Traditional Auto Loans

Strong Credit Score: A credit score of 670 or higher is generally preferred.

Subprime Auto Loans

These loans are designed for individuals with lower credit scores. However, they come with higher interest rates and less favorable terms.

Considerations for Subprime Loans

Higher Interest Rates: Expect significantly higher interest rates than traditional loans.

Personal Loans

Personal loans can be used for various purposes, including vehicle purchases. They may be an option for Uber drivers with moderate credit scores.

Advantages of Personal Loans

Unsecured Options: Some personal loans are unsecured, meaning they don’t require collateral.

Disadvantages of Personal Loans

Higher Interest Rates: Interest rates may be higher than secured auto loans.

Ride-Sharing Specific Financing Programs

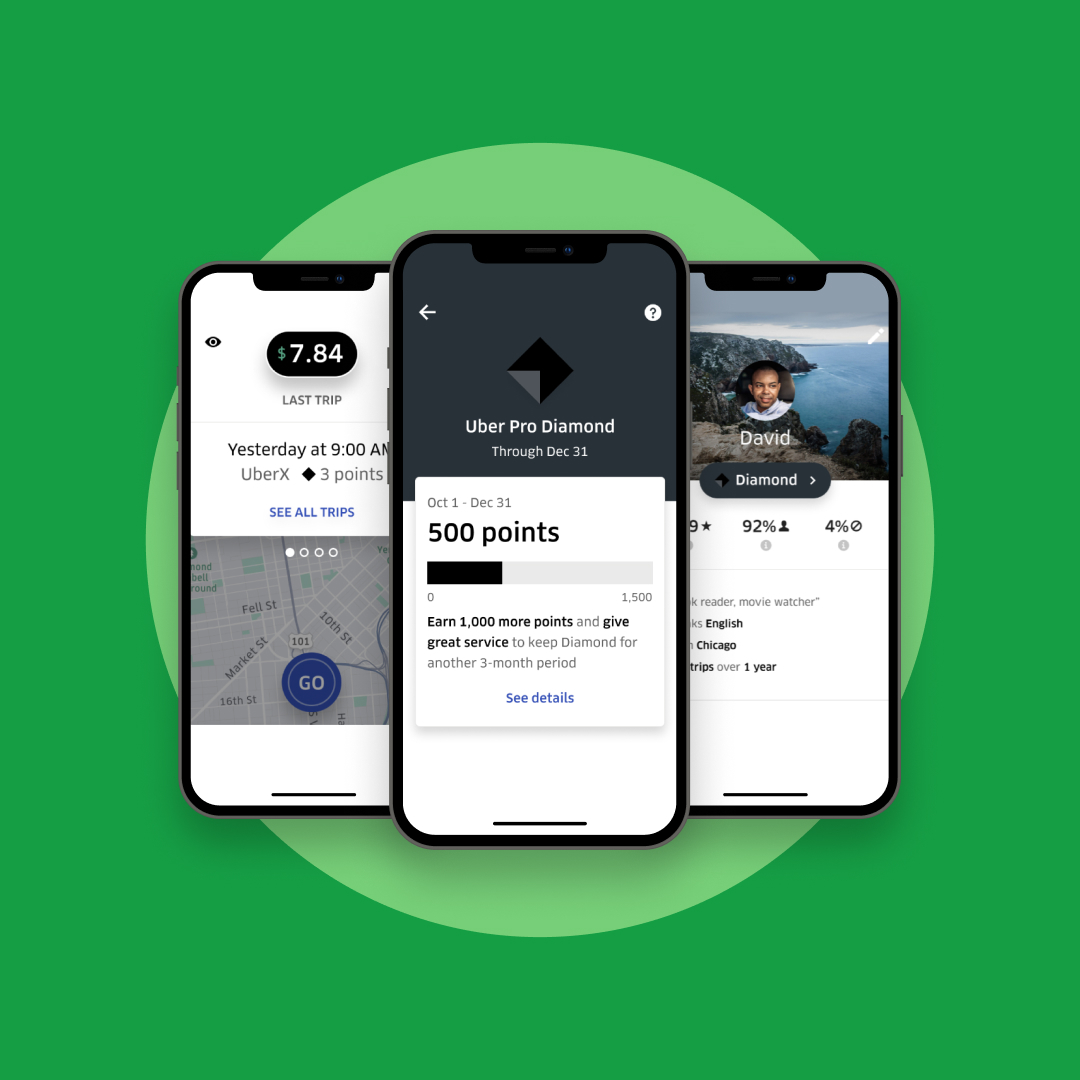

Some financial institutions and ride-sharing companies offer programs specifically designed for Uber drivers.

Examples of Ride-Sharing Programs

Some automotive companies offer special financing with ride sharing drivers in mind.

Benefits of Ride-Sharing Programs

Tailored Requirements: These programs may have more lenient requirements for Uber drivers.

Uber drivers can take several steps to improve their chances of securing vehicle financing.

Build a Strong Credit Score

A good credit score is essential for securing favorable loan terms.

Steps to Improve Your Credit Score

Pay Bills on Time: Make all payments on time to avoid late fees and negative marks on your credit report.

Document Your Income Thoroughly

Banks require proof of income, which can be challenging for Uber drivers.

Methods for Documenting Income

Tax Returns: Provide copies of your tax returns for the past two years.

Save for a Down Payment

A larger down payment can reduce the loan amount and demonstrate financial responsibility.

Benefits of a Down Payment

Lower Monthly Payments: A larger down payment reduces the loan amount, resulting in lower monthly payments.

Improve Your Debt-to-Income Ratio (DTI)

A low DTI is crucial for loan approval.

Strategies for Lowering Your DTI

Pay Down Debt: Reduce existing debt to lower your monthly obligations.

Consider a Co-Signer

If you have a limited credit history or low credit score, a co-signer with a strong credit profile can improve your chances of approval.

Requirements for a Co-Signer

Strong Credit Score: The co-signer should have a strong credit score and a stable income.

Shop Around for the Best Rates

Don’t settle for the first loan offer you receive. Shop around and compare rates from multiple lenders.

Where to Shop for Loans

Banks: Contact your local bank or credit union.

The financial industry is gradually adapting to the needs of gig economy workers.

Technological Advancements

Fintech companies are developing innovative solutions that leverage technology to assess creditworthiness based on alternative data sources, such as ride-sharing earnings and payment history.

Increased Flexibility

Banks and financial institutions are beginning to recognize the unique financial profiles of gig economy workers and are offering more flexible loan terms and requirements.

Partnerships and Collaborations

Ride-sharing companies and financial institutions are forming partnerships to offer tailored financing programs for drivers.

Securing vehicle financing as an Uber driver requires careful planning and preparation. By understanding the challenges and taking proactive steps to improve their financial profile, drivers can increase their chances of obtaining favorable loan terms. Building a strong credit score, documenting income thoroughly, and shopping around for the best rates are essential strategies. As the gig economy continues to evolve, the financial industry is adapting to meet the needs of independent contractors, offering greater flexibility and accessibility to financing options. By staying informed and proactive, Uber drivers can navigate the financial road and achieve their goals.