Absolutely! Here’s a long article (around 3000 words) about international purchase order financing, with the list items replaced by `

` or `

` tags for a more structured, heading-based format.

In the dynamic landscape of international trade, businesses often encounter a significant hurdle: securing the necessary capital to fulfill large purchase orders from overseas suppliers. This is where international purchase order (PO) financing emerges as a crucial financial instrument, enabling companies to bridge the gap between order placement and customer payment. This article delves into the intricacies of international PO financing, exploring its benefits, challenges, and best practices.

International PO financing is a short-term funding solution that provides businesses with the capital required to pay their suppliers for goods before those goods are shipped or delivered. It essentially allows companies to leverage their confirmed purchase orders as collateral to obtain funding. This type of financing is particularly beneficial for businesses that:

Experience Cash Flow Constraints

Many businesses, especially small and medium-sized enterprises (SMEs), face cash flow challenges when dealing with large international orders. PO financing addresses this issue by providing the necessary funds to pay suppliers upfront, ensuring timely order fulfillment.

Deal with Long Lead Times

International supply chains often involve lengthy lead times, from order placement to final delivery. PO financing helps bridge the financial gap during this period, preventing delays and ensuring smooth operations.

Require Large Upfront Payments

Many overseas suppliers demand significant upfront payments before commencing production. PO financing enables businesses to meet these requirements, fostering stronger supplier relationships and securing favorable terms.

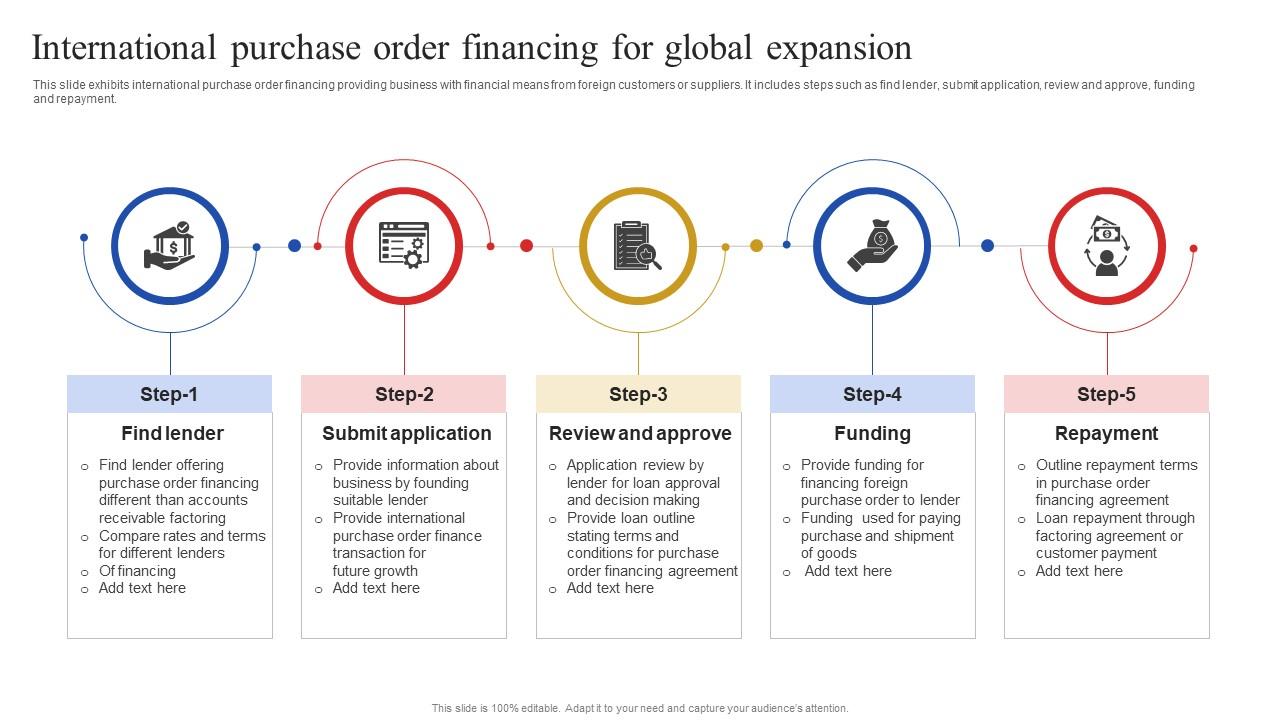

The process of securing international PO financing typically involves the following steps:

Order Confirmation

The buyer receives a confirmed purchase order from their customer, outlining the details of the goods to be purchased.

Application for Financing

The buyer applies for PO financing with a specialized lender, providing the purchase order, supplier information, and other relevant documentation.

Due Diligence

The lender conducts thorough due diligence, assessing the buyer’s creditworthiness, the supplier’s reputation, and the viability of the transaction.

Funding Approval

Upon approval, the lender provides the necessary funds to the buyer’s supplier, either directly or through an escrow account.

Goods Shipment and Delivery

The supplier ships the goods to the buyer, who then delivers them to their customer.

Invoice Settlement

The buyer’s customer pays the invoice, and the buyer uses these funds to repay the lender, along with any applicable fees and interest.

International PO financing offers several significant advantages for businesses engaged in global trade:

Improved Cash Flow Management

By providing upfront funding, PO financing helps businesses manage their cash flow more effectively, ensuring they can meet their financial obligations.

Increased Sales Opportunities

With access to funding, businesses can accept larger orders and expand their sales opportunities, even if they lack the immediate cash reserves.

Enhanced Supplier Relationships

Timely payments to suppliers foster stronger relationships and can lead to favorable terms, such as discounts or extended payment periods.

Reduced Risk

PO financing can mitigate the risk of order delays or cancellations due to financial constraints, ensuring a smoother supply chain.

Scalability

PO financing allows businesses to scale their operations by taking on larger orders and expanding their customer base without straining their financial resources.

While international PO financing offers numerous benefits, it’s essential to be aware of the potential challenges and considerations:

Cost of Financing

PO financing typically involves fees and interest, which can impact the overall profitability of the transaction. Businesses must carefully evaluate the costs and ensure they align with their financial goals.

Due Diligence Requirements

Lenders conduct thorough due diligence, which can be time-consuming and require extensive documentation. Businesses must be prepared to provide all necessary information.

Supplier Reliability

The success of PO financing relies heavily on the supplier’s ability to fulfill the order according to the agreed-upon terms. Businesses must ensure they are working with reputable and reliable suppliers.

Currency Fluctuations

International transactions are subject to currency fluctuations, which can impact the cost of goods and the overall profitability of the deal. Businesses should consider hedging strategies to mitigate this risk.

Legal and Regulatory Compliance

International trade involves complex legal and regulatory requirements, which businesses must adhere to. Failure to comply can result in penalties and delays.

To maximize the benefits of international PO financing and mitigate potential risks, businesses should adhere to the following best practices:

Choose a Reputable Lender

Select a lender with experience in international trade and a proven track record of providing reliable PO financing solutions.

Conduct Thorough Due Diligence

Carefully evaluate the supplier’s reputation, financial stability, and ability to fulfill the order. Ensure all necessary documentation is accurate and complete.

Negotiate Favorable Terms

Negotiate the terms of the financing agreement, including fees, interest rates, and repayment schedules, to ensure they align with your financial goals.

Manage Currency Risk

Implement hedging strategies to mitigate the impact of currency fluctuations on your transactions.

Maintain Clear Communication

Maintain clear and consistent communication with your lender, supplier, and customer throughout the transaction.

Plan for Contingencies

Develop contingency plans to address potential challenges, such as supplier delays or quality issues.

As global trade continues to expand, international PO financing is poised to play an increasingly vital role in facilitating cross-border transactions. Advances in technology, such as blockchain and digital platforms, are streamlining the financing process and making it more accessible to businesses of all sizes.

Technological Advancements

Blockchain technology can enhance transparency and security in international trade transactions, while digital platforms can simplify the application and approval process for PO financing.

Increased Accessibility

As more lenders enter the market, PO financing is becoming more accessible to SMEs, enabling them to compete in the global marketplace.

Specialized Solutions

Lenders are developing specialized PO financing solutions tailored to specific industries and markets, addressing the unique needs of different businesses.

International purchase order financing is a powerful tool that empowers businesses to overcome financial hurdles and capitalize on global trade opportunities. By understanding the mechanics, benefits, and challenges of PO financing, businesses can effectively leverage this financial instrument to fuel their growth and success in the international arena. As the global economy continues to evolve, PO financing will remain a crucial component of the international trade ecosystem, enabling businesses to thrive in an increasingly interconnected world.