“`html

Security finance Antigo: A Deep Dive into Its Legacy and Evolution

Security Finance Antigo: A Deep Dive into Its Legacy and Evolution

Security Finance, a name familiar to many in the southern United States, particularly those who have navigated the complexities of personal finance, carries a rich history. “Antigo,” the Portuguese word for “old” or “ancient,” fittingly evokes the company’s long-standing presence. This article delves into the intricate tapestry of Security Finance’s past, exploring its origins, growth, and the evolution of its business practices. We will examine the company’s role in providing financial services to underserved communities, its adaptation to changing economic landscapes, and the challenges it has faced along the way.

Origins and Early Years: Filling a Financial Void

The story of Security Finance begins in the mid-20th century, a period marked by significant economic and social shifts. In the post-World War II era, many individuals and families struggled to access traditional banking services. This financial exclusion created a demand for alternative lending options, particularly in smaller towns and rural areas. Security Finance emerged to fill this void, providing small, short-term loans to individuals who might not qualify for loans from traditional banks.

The company’s early business model was rooted in personal relationships and community ties. Local offices were staffed by individuals who understood the needs of their neighbors. This personalized approach fostered trust and loyalty, enabling Security Finance to establish a strong foothold in its target markets. The core mission was to provide accessible credit to those who needed it most, often for essential expenses like medical bills, car repairs, or home improvements.

The Role of Personal Relationships in Early Growth

In the early days, loan approvals were often based on character and reputation rather than strict credit scores. Loan officers took the time to understand each applicant’s financial situation, considering factors beyond traditional credit metrics. This emphasis on personal relationships was a key differentiator for Security Finance, setting it apart from larger, more impersonal financial institutions.

Adapting to Post-War Economic Realities

The post-war economy presented both opportunities and challenges. While the overall economy was growing, many individuals faced financial instability. Security Finance’s flexible lending practices allowed it to serve those who were navigating these economic uncertainties. The company’s ability to adapt to changing economic realities was crucial to its early success.

Expansion and Growth: Reaching New Communities

As Security Finance’s reputation grew, so did its geographic footprint. The company expanded its network of branches, reaching new communities across the southern United States. This expansion was driven by a combination of organic growth and strategic acquisitions. Security Finance’s commitment to serving underserved markets remained a constant throughout its expansion.

The company’s growth was also facilitated by its ability to adapt to evolving regulatory environments. As consumer protection laws became more stringent, Security Finance adjusted its lending practices to ensure compliance. This adaptability allowed the company to maintain its competitive edge while adhering to regulatory requirements.

Strategic Acquisitions and Market Penetration

Security Finance’s expansion strategy included acquiring smaller, local finance companies. These acquisitions allowed the company to quickly establish a presence in new markets and gain access to established customer bases. The integration of acquired companies was a key component of Security Finance’s growth strategy.

Technological Advancements and Operational Efficiency

As technology advanced, Security Finance began to incorporate new tools and systems into its operations. The introduction of computer systems and automated processes improved efficiency and allowed the company to handle a larger volume of loan applications. These technological advancements were essential for supporting the company’s continued growth.

Evolution of Business Practices: Adapting to Changing Times

Security Finance’s business practices have evolved significantly over the years. The company has adapted to changes in consumer preferences, technological advancements, and regulatory requirements. This evolution has been driven by a need to remain competitive and meet the changing needs of its customers.

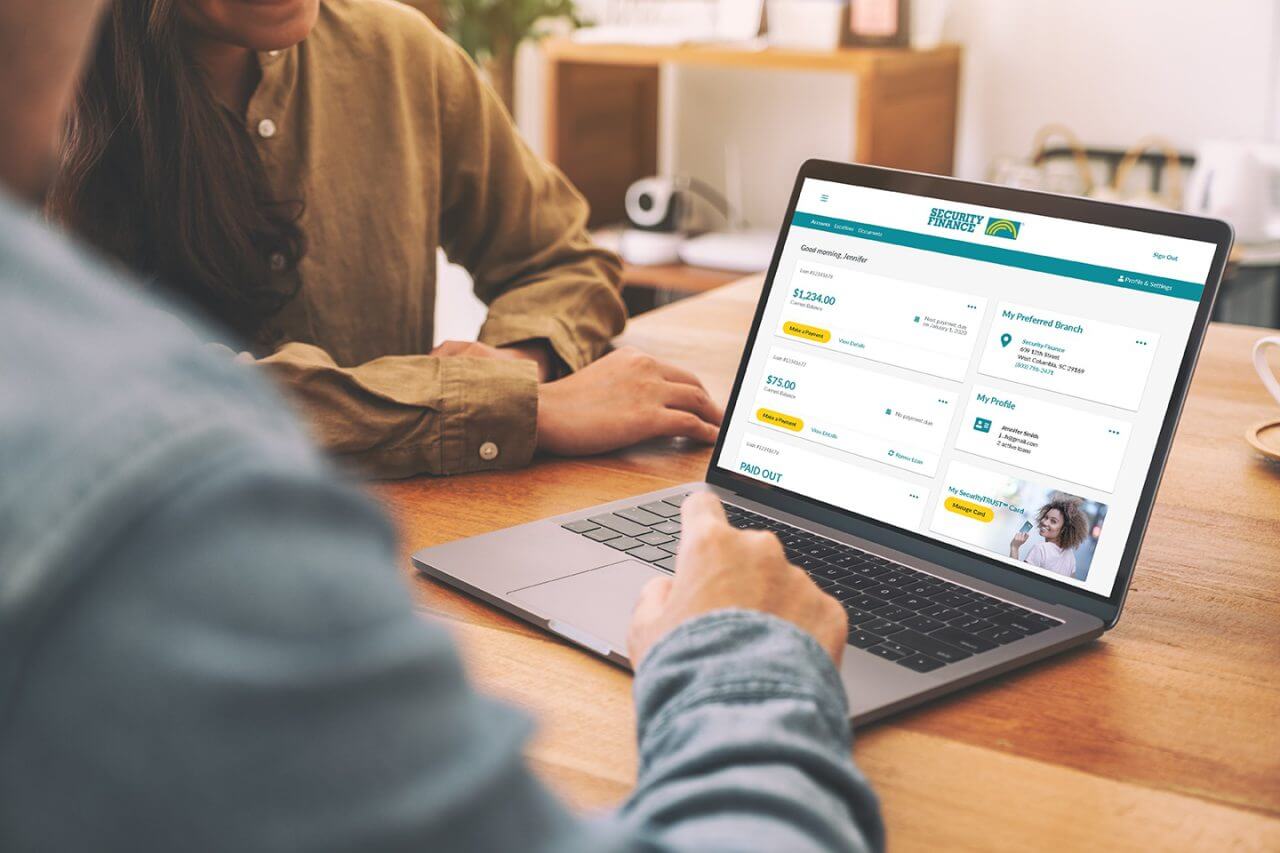

In recent decades, Security Finance has placed a greater emphasis on online lending and digital services. This shift reflects the growing preference for online transactions and the increasing availability of internet access. The company’s online platform allows customers to apply for loans, manage their accounts, and make payments from the convenience of their homes.

The Shift to Online Lending and Digital Services

The rise of online lending has transformed the financial services industry. Security Finance’s investment in digital technology has allowed it to remain competitive in this rapidly evolving market. The company’s online platform has expanded its reach and made its services more accessible to a wider range of customers.

Compliance and Regulatory Changes

The financial services industry is subject to a complex web of regulations. Security Finance has invested significant resources in ensuring compliance with these regulations. The company’s commitment to compliance has helped it maintain its reputation and avoid legal challenges.

Customer Service and Community Engagement

While technology has played an increasingly important role in Security Finance’s operations, the company has continued to emphasize customer service and community engagement. Local branches remain an important part of the company’s business model, providing personalized service and support to customers. Security Finance also engages in community outreach programs, supporting local initiatives and organizations.

Challenges and Criticisms: Navigating a Complex Landscape

Like many companies in the consumer finance industry, Security Finance has faced its share of challenges and criticisms. The company’s lending practices have been scrutinized by consumer advocacy groups and regulatory agencies. Critics have raised concerns about the high interest rates charged on some of its loans and the potential for borrowers to become trapped in cycles of debt.

Security Finance has responded to these criticisms by emphasizing its commitment to responsible lending practices. The company has implemented policies and procedures designed to ensure that borrowers understand the terms of their loans and are able to repay them. Security Finance also offers financial education resources to help customers improve their financial literacy.

Criticisms Regarding Interest Rates and Lending Practices

The high interest rates charged by some consumer finance companies have been a subject of ongoing debate. Critics argue that these rates can be predatory, trapping borrowers in cycles of debt. Security Finance has defended its interest rates by pointing to the risks associated with lending to individuals with limited credit histories.

Regulatory Scrutiny and Consumer Protection

Regulatory agencies have increased their scrutiny of the consumer finance industry in recent years. Security Finance has faced regulatory challenges related to its lending practices and compliance with consumer protection laws. The company has responded by strengthening its compliance programs and working to address regulatory concerns.

The Impact of Economic Downturns

Economic downturns can have a significant impact on consumer finance companies. During periods of economic hardship, borrowers may struggle to repay their loans, leading to increased delinquency rates and losses. Security Finance has navigated several economic downturns over the years, adapting its lending practices and risk management strategies to mitigate the impact of these challenges.

The Future of Security Finance: Adapting to a Changing World

Security Finance’s future will depend on its ability to adapt to a rapidly changing financial landscape. The company must continue to innovate and embrace new technologies to remain competitive. It must also address the challenges posed by regulatory scrutiny and consumer advocacy. By staying true to its mission of providing accessible credit to underserved communities, Security Finance can continue to play a vital role in the financial lives of its customers.

Embracing Technological Innovation

Technological innovation will play a crucial role in the future of Security Finance. The company must continue to invest in digital technologies to enhance its online platform, improve operational efficiency, and provide a seamless customer experience. The use of artificial intelligence and machine learning can also help the company make more informed lending decisions and manage risk more effectively.

Strengthening Community Ties and Financial Literacy

Security Finance can strengthen its position by deepening its ties to the communities it serves. By investing in financial literacy programs and community outreach initiatives, the company can build trust and demonstrate its commitment to responsible lending. These efforts can help to address concerns about the company’s lending practices and enhance its reputation.

Navigating Regulatory Uncertainty

The regulatory landscape for consumer finance companies is likely to remain complex and uncertain. Security Finance must continue to prioritize compliance and adapt to new regulations. By staying ahead of regulatory changes, the company can minimize its risk and ensure its long-term sustainability.

Conclusion: A Legacy of Service and Adaptation

Security Finance’s journey is a testament to its ability to adapt and evolve over time. From its humble beginnings in the mid-20th century to its current position as a leading provider of consumer finance services, the company has consistently sought to meet the changing needs of its customers. While it has faced challenges and criticisms, Security Finance’s commitment to serving underserved communities remains a core part of its identity. As the financial landscape continues to evolve, Security Finance must continue to innovate and adapt to ensure its long-term success. The legacy of “Security Finance Antigo” is one of enduring service and adaptation, a story that continues to unfold.

“`