Absolutely! Let’s craft a comprehensive 3000-word article about seller financing for a business, using `

` and `

` for subheadings.

Seller financing, also known as owner financing, is a creative and flexible way to structure the sale of a business. Instead of relying solely on traditional bank loans, the seller acts as the lender, providing a portion or all of the financing to the buyer. This arrangement can be mutually beneficial, offering advantages for both parties involved.

What is Seller Financing?

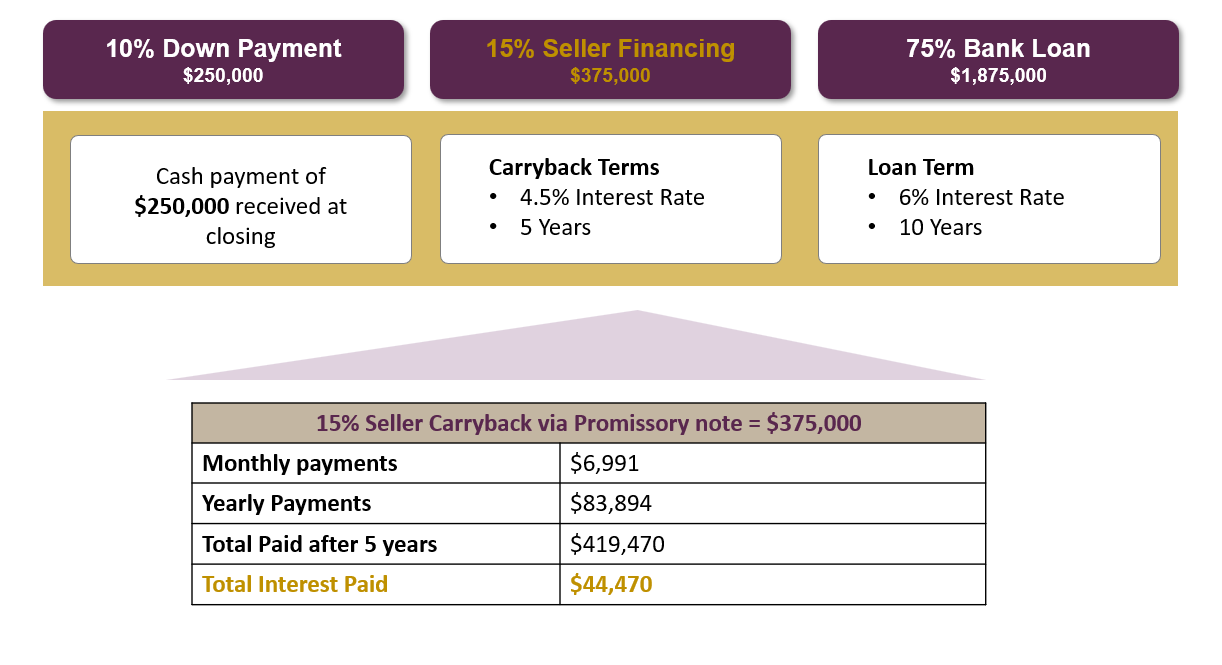

Seller financing occurs when the seller of a business agrees to lend the buyer a portion or all of the purchase price. In essence, the buyer makes payments to the seller over a predetermined period, much like a traditional loan. This arrangement is documented in a promissory note, which outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved.

Key Components of Seller Financing

Promissory Note: This is the legal document that formalizes the loan agreement. It specifies the loan amount, interest rate, repayment terms, and any default provisions.

Benefits of Seller Financing for Buyers

Seller financing can be an attractive option for buyers who may have difficulty securing traditional bank loans.

Increased Access to Financing

For buyers with limited credit history or insufficient collateral, seller financing can provide a pathway to business ownership that might otherwise be unavailable.

Faster Closing Process

Compared to the often lengthy and complex process of obtaining a bank loan, seller financing can expedite the closing process.

Flexible Terms

Buyers can negotiate favorable loan terms with the seller, such as lower interest rates or more flexible repayment schedules.

Seller’s Confidence

Benefits of Seller Financing for Sellers

Seller financing can also be advantageous for sellers, offering potential benefits that traditional sales may not provide.

Higher Sale Price

By offering financing, sellers can attract a wider pool of potential buyers, potentially leading to a higher sale price.

Steady Income Stream

Seller financing provides a steady income stream through interest payments and principal repayments.

Tax Advantages

Sellers may be able to defer capital gains taxes by spreading out the payments over time.

Increased Control

The seller retains some control over the business until the loan is fully repaid.

Easier Business Transition

Risks and Considerations for Buyers

While seller financing offers numerous benefits, buyers should be aware of the potential risks and considerations.

Seller’s Financial Stability

Buyers should assess the seller’s financial stability to ensure they can fulfill their obligations under the loan agreement.

Potential for Disputes

Disputes can arise between the buyer and seller regarding loan terms or repayment issues.

Balloon Payments

Some seller financing agreements include a balloon payment, which requires the buyer to make a large lump-sum payment at the end of the term.

Due on Sale Clauses

Risks and Considerations for Sellers

Sellers also face potential risks and considerations when offering seller financing.

Default Risk

The buyer may default on the loan, leaving the seller with the burden of recovering the outstanding balance.

Foreclosure Process

If the buyer defaults, the seller may need to initiate foreclosure proceedings, which can be time-consuming and costly.

Opportunity Cost

By providing financing, the seller may forgo other investment opportunities.

Ongoing Involvement

Structuring a Seller Financing Agreement

A well-structured seller financing agreement is crucial for protecting the interests of both the buyer and seller.

Due Diligence

Both parties should conduct thorough due diligence to assess the financial health of the business and the creditworthiness of the buyer.

Legal Documentation

The promissory note and other legal documents should be drafted by an experienced attorney to ensure they are legally sound and protect the interests of both parties.

Negotiation

The terms of the seller financing agreement should be negotiated in good faith and reflect the mutual agreement of both parties.

Professional Advice

Amortization Schedules

When Seller Financing is Most Appropriate

Seller financing is particularly suitable in certain situations.

Small to Medium-Sized Businesses

Businesses with Strong Cash Flow

Buyers with Limited Credit History

Sellers Seeking Passive Income

Conclusion

Seller financing can be a valuable tool for facilitating the sale of a business. By understanding the benefits, risks, and considerations involved, both buyers and sellers can structure a mutually beneficial agreement. Careful planning, thorough due diligence, and professional guidance are essential for a successful seller financing transaction.